Why is Scrub Daddy Company for Sale Even After $220 million in Revenue?

Imagine running a company that pulls in $220 million in just one year. Most would cling to such a successful enterprise, yet the founder of Scrub Daddy, Aaron Krause, is contemplating a sale. The home cleaning brand Scrub Daddy has made a splash in the market with its innovative sponges and cleaning tools. However, Reuters reported that the founder might put the company up for sale, even after hitting an impressive $220 million sales for 2023. In its peak time, why did Aaron think of selling the Scrub Daddy? Why Selling Now? Why would a founder like Aaron consider selling a flourishing business like Scrub Daddy? In the business world, there can be several personal and professional reasons to sell their company. But this is…

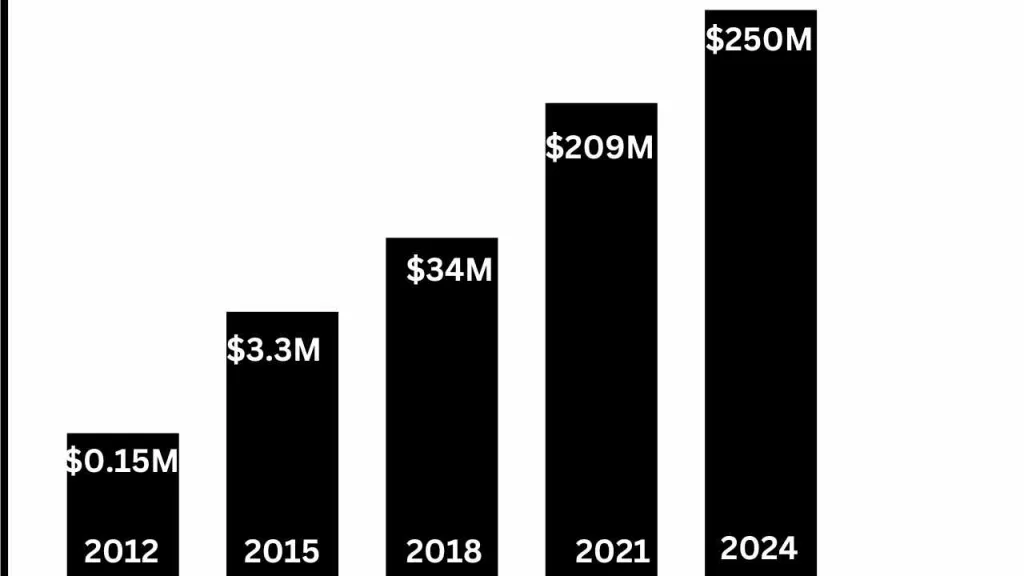

Imagine running a company that pulls in $220 million in just one year. Most would cling to such a successful enterprise, yet the founder of Scrub Daddy, Aaron Krause, is contemplating a sale. The home cleaning brand Scrub Daddy has made a splash in the market with its innovative sponges and cleaning tools. However, Reuters reported that the founder might put the company up for sale, even after hitting an impressive $220 million sales for 2023. In its peak time, why did Aaron think of selling the Scrub Daddy?

Why Selling Now?

Why would a founder like Aaron consider selling a flourishing business like Scrub Daddy? In the business world, there can be several personal and professional reasons to sell their company. But this is not a wonder. If you remember the Ring doorbell company, You know what I mean. Ring, founded by Jamie Siminoff, sold his startup to Amazon in 2018 for a staggering $1 billion. Actually, selling their startup in the business world is not a wonder. Not only in the Shark Tank but also your favorite shark, Mark Cuban also became a billionaire in 1999 by selling his startup, Broadcast.com, for $5.7 billion.

But why did Aaron sell his company right at its peak? To understand this, we must examine potential motivations such as the desire for further expansion that might require more capital than currently available, increased competition, or even market saturation. Also, there is the money thing. Selling a startup is like a payday to the founder. As of today, Scrub Daddy has an estimated net worth of $250 million. If Aaron sold the company right now, just for 250 million, he would most likely make nearly $200 million from it. So why not sell, right?

Another factor could be the personal goals of the founder—does he seek new ventures or perhaps a break from the demands of managing a high-growth company? Some entrepreneurs innovate things not just only for money. It’s their hobby. When they feel enough with sticking to the product, they just sell that and go to new innovations.

The Business Lifecycle and Exit Strategies

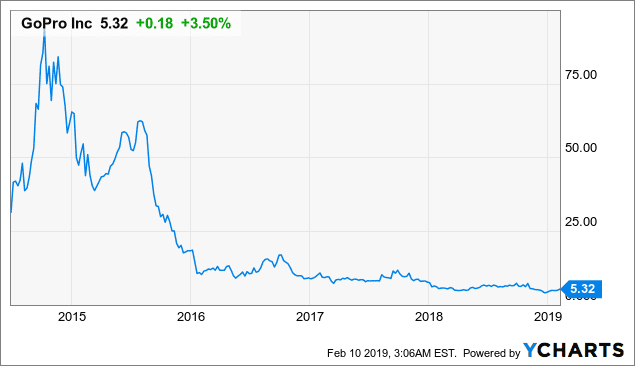

Businesses, like living entities, go through various stages in their lifecycle, with each stage presenting an exit opportunity. The best example of this is GoPro. GoPro was once a multi-billion company. Even its founder, Nick Woodman, appeared in the Shark Tank as Guess Shark. But after years, now company’s net worth is around 337.27 million. It’s not uncommon for successful entrepreneurs to devise exit strategies to maximize returns or to pursue other interests. Examples abound in the industry where business founders sell at the peak of their success to leverage a high valuation.

Strategic Advantages of Selling

A sale can be more than just an exit; it can safeguard the company’s future. By finding the right buyer, Scrub Daddy could gain access to greater resources or specialized expertise.

This move could secure the brand’s legacy in a competitive cleaning products market, ensuring its continual growth and innovation. Not only that this is the best time to bargain for the best price for scrub daddy. Online sources reveal that, in 2023, Scrub Daddy has made $220 million in sales.

Challenges and Considerations for the Sale

Selling a business you’ve built from the ground up is never easy. There’s an emotional aspect to consider: risks of cultural shifts post-sale and ensuring the new owners maintain the established brand values. To Aaron, this is his first startup. Also, he founded the scrub daddy in 2012, and this is 2024. He has spent more than a decade building his startup from scratch. So it is not easy for him to just sell it. The founder must weigh these against the potential financial incentives of selling.

Background and Success Story

Let’s go back to where it all started. Scrub Daddy found its fame on ‘Shark Tank,‘ where its founder pitched the innovative sponge that changes texture with water temperature. The deal struck on the show was pivotal, propelling the brand to new heights. Since its TV debut, the company has experienced staggering growth, with its products becoming household names and building a strong market presence and admirable brand reputation.

It was Lori Greiner who saw the potential in the product and offered $200,000 for a 20% stake. The decision led both Greiner and the founder to substantial financial success. This investment has seen returns manifold as Scrub Daddy expanded its reach and diversified its product lineup.

The Future of Scrub Daddy

What does this mean for the future of Scrub Daddy? With change comes opportunity—the sale could open doors to new markets and the introduction of fresh ideas. There are uncertainties, of course, but with a solid foundation and a recognized brand, Scrub Daddy’s prospects look bright, whether under new ownership or through strategic partnerships.

Conclusion

In short, the $220 million sales mark is a testament to Scrub Daddy’s success. However, the decision to potentially sell the company highlights how strategic considerations often extend beyond immediate financial performance. It’s a complex matrix of business viability, personal aspirations, and future-proofing the brand. While the sponge’s texture might change with temperature, the resilience and adaptability of the brand itself will likely remain constant, no matter who holds the reins.