What Is ID Verification, And Why Is It Important?

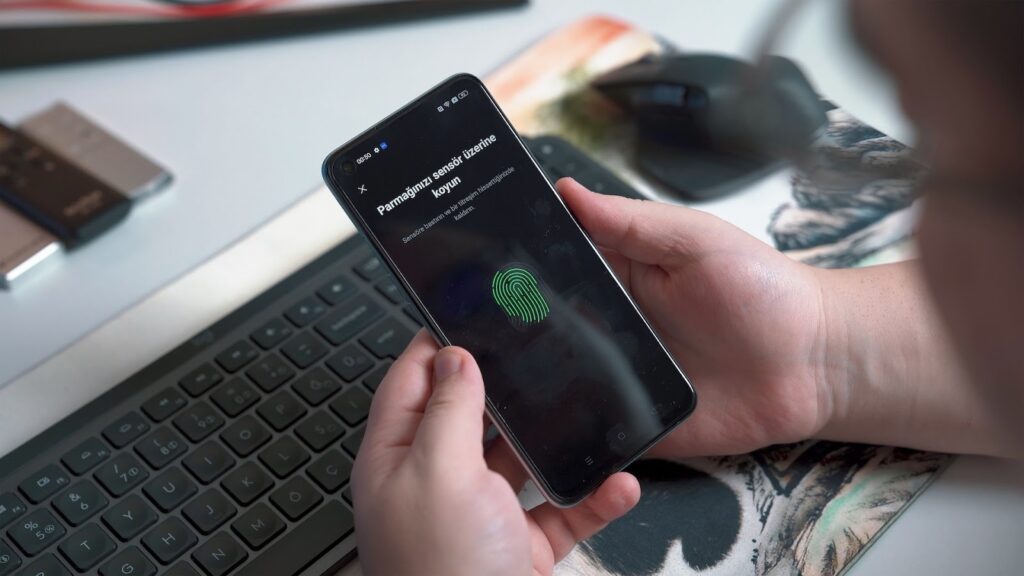

Since there has been an increase in identity theft and account takeovers, businesses need a sure way to confirm their customers’ identities. Checking someone’s credentials before letting them handle your hard-earned cash, open a bank account, or apply for a loan is crucial. Financial organizations utilize identity verification as a fraud deterrent for new accounts and a risk assessment and monitoring tool. ID verification systems that quickly and accurately verify people’s identities are essential for any business. Image source What Is ID Verification? ID verification is checking the authenticity of a person’s identification documents. It entails comparing the provided information with what is available in the official databases. ID verification is essential for security and trust purposes, especially for financial institutions, online service providers, and…

Since there has been an increase in identity theft and account takeovers, businesses need a sure way to confirm their customers’ identities. Checking someone’s credentials before letting them handle your hard-earned cash, open a bank account, or apply for a loan is crucial.

Financial organizations utilize identity verification as a fraud deterrent for new accounts and a risk assessment and monitoring tool. ID verification systems that quickly and accurately verify people’s identities are essential for any business.

What Is ID Verification?

ID verification is checking the authenticity of a person’s identification documents. It entails comparing the provided information with what is available in the official databases. ID verification is essential for security and trust purposes, especially for financial institutions, online service providers, and the government.

With ongoing information technology advances, balancing verification practices to avoid excessive user complexity is important. You also need a reputable partner to help you out at a reasonable cost when it comes to ID verification. Authenticate is the industry leader with award-winning industry knowledge and tools vital for ID verification.

Don’t compromise on security or user convenience. Instead, work with Authenticate for hassle-free, effective, and innovative ID verification.

5 Importance of ID Verification

1. Improve Reputation

For companies of any size, reputation is key. Due to the abundance of options available nowadays, customers quickly switch brands if a product falls short of their expectations. On top of that, people are more concerned than ever about business dealing with companies they can trust.

Consumers in this era of frequent data breaches naturally worry about the security of their personal information. Identity verification shows you care about safety in the increasingly risky digital environment.

Establishing trust in the ever-changing digital world builds a business’ reputation. If a customer’s demands aren’t being met or if they’re unhappy with the service they’re receiving, they may and will go to a competitor.

A company’s reputation and bottom line might take a hit if they fail to recognize the importance of building trust with its target audience. On the flip hand, improving your company’s image and speedy identity verification aids in gaining that crucial consumer confidence.

2. Avoid Chargebacks

Fraud became easier as “card-not-present” transactions increased when firms allowed buyers to use credit cards for online purchases.

Unknown individuals can now make online purchases using stolen credit cards, only to have the original cardholder dispute the charge after discovering the theft. In most cases, the involved company has to refund the funds even if the original fraudster cannot be located. In the finance industry, this is referred to as a chargeback.

Businesses that allow credit card payments can lose two to three times the value of a refunded transaction due to fees, operational expenditures, and customer acquisition costs.

Chargeback cases are now effectively counteracted due to the identity verification measures, which thoroughly verify every consumer. As soon as the ID Card Centre gets the necessary documents, they swiftly verify the consumer’s identity using advanced technology to ensure accuracy. This verification process significantly reduces the risk of fraudulent chargebacks and enhances overall security for both businesses and consumers.

For many companies, updating their identity verification policies for card-not-present transactions to include one or more identification techniques is all it takes to avoid incurring expensive chargebacks.

3. Enhance Customer Experience

Companies that focus on their customers’ wants and requirements are winning over customers in today’s market. Therefore, a good user interface will facilitate the customer’s expectations.

Obtaining required information from other parties rather than the customer directly is a key component of “frictionless” identity verification processes. This paves the way for the development of a paperless, digital process that saves significant amounts of time and effort over its predecessor.

The onboarding process is streamlined, and customers may start using your service right away.

Due to the speed and efficiency with which digital identity verification may be completed in the background, the shift to a digital process is much more customer-friendly.

Increased conversion rates are directly proportional to the efficiency and speed with which identification is verified. If customers have a good time, they are more likely to return.

4. Ensure Federal Compliance

Consumer identification systems risk violating state and federal privacy laws if they are not managed properly. Several data privacy standards require informed permission and forewarning before processing personal information like facial recognition and other biometrics.

Identity verification is important because it prevents unlawful transactions, but skipping it can result in penalties and jail time.

You can’t trust what you see on the surface. Therefore, it’s best to utilize a system that verifies user identities with photos or videos.

5. Prevent Fraud

It’s important to note that even a small business can be crushed by unfounded accusations of money laundering. Organizations of all sizes rely on risk-based models to identify the customers who pose the most significant security risk, and identity verification is an integral part of these models. More stringent checks are needed for high-risk financial dealings.

The use of an identity management system has been shown to lessen the possibility of fraud. This is why all monetary institutions need confirmation of identification. It helps stop illegal actions like money laundering.

Conclusion

Identity verification systems are constantly evolving and improving. Some speculate that in a few generations, everyone online will have a decentralized identity made possible by the blockchain.

Effective use of identity verification helps improve a company’s reputation and also helps in avoiding heavy chargebacks. To enhance customer experience and satisfaction, you also need a reliable ID verification system. It will still ensure that your organization complies with federal rules and regulations.