Financial management has seen a significant shift in an era of digital transformation. According to a survey by Bankrate, nearly 63% of smartphone users possess a minimum of one financial application. This staggering figure is a testament to the growing reliance on technology for monetary matters.

Money-tracking apps are at the forefront of this revolution, helping individuals monitor their spending habits, manage their savings, and achieve financial stability with just a few taps.

These apps are more than just digital wallets or online budget sheets; they’re personalized financial assistants, offering insights into our spending patterns and nudging us toward smart money management—no wonder they’re changing how we handle our hard-earned money, one transaction at a time. Read on and discover how they’re revolutionizing our financial habits.

The Evolution of Money Management

Managing money has evolved drastically over centuries, from tangible assets like gold and livestock to paper currency and digital forms. This shift mirrors broader societal changes, reflecting our growing needs and aspirations.

As we delve into modern financial management, we’ll see how technology, particularly money-tracking apps, has transformed our approach to personal finance. Let’s take a closer look.

History of manual budgeting: From ledgers to spreadsheets

The transition from ledgers to spreadsheets marked a significant revolution in manual budgeting. Initially, financial records were maintained in physical ledgers, involving meticulous hand-written entries. These books allowed for basic accounting, tracking the inflow and outflow of money. However, this process was time-consuming and prone to errors.

With the advent of computers, spreadsheets replaced traditional ledgers, simplifying financial management considerably. Microsoft Excel became the go-to tool for tracking expenses, offering a numerical playground with rows and columns. It automated calculations, reduced human errors, and saved time, representing a significant leap in personal finance management.

The introduction of digital aids: Early finance software to present-day apps

Early finance software paved the way for digital money management. These software were primarily desktop-based, offering basic functionalities like expense tracking and bill payments.

Over time, they evolved to include investment management and tax planning features, creating a comprehensive financial toolkit. However, their accessibility remained limited to personal computers, restricting on-the-go updates.

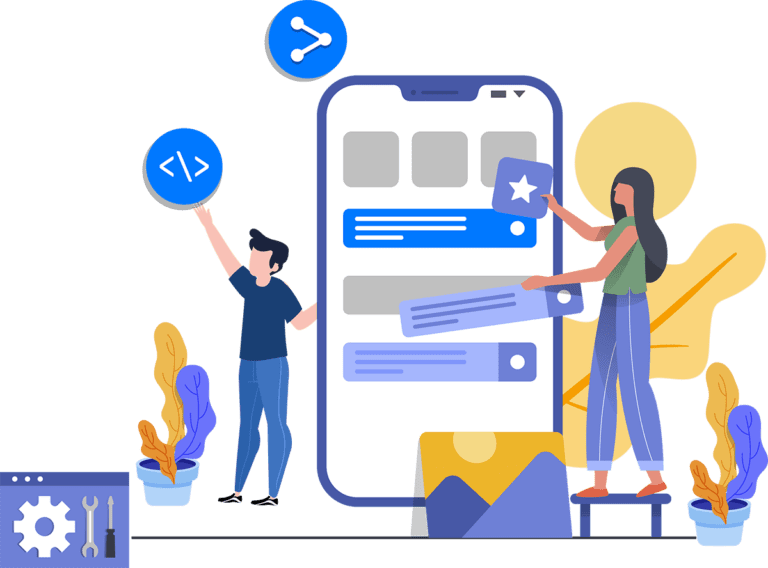

The introduction of smartphones changed this landscape. Today, a money-tracking app harnesses the power of mobility, enabling real-time tracking of expenses, investments, and savings. These apps are user-friendly, interactive, and adaptable, offering personalized financial insights at your fingertips.

What are money-tracking apps?

A money-tracking app is an advanced digital tool that helps individuals manage their finances. These applications provide a comprehensive view of your income, expenses, and savings. They automatically categorize your spending into various buckets like groceries, utilities, and entertainment. This feature lets you understand where your money is going, promoting conscious and efficient spending.

Furthermore, these apps also provide timely reminders for bill payments, preventing late fees. They offer customized financial advice, budgeting tips, and goal-setting features, making them a one-stop solution for personal finance management.

Benefits of Using Money-Tracking Apps

Adopting money-tracking apps can be a game-changer in managing personal finances. With an array of practical features, they simplify the often daunting task of budgeting. Let’s delve into the compelling benefits they offer.

Real-time expense tracking

Real-time expense tracking offers immediate updates on your spending. As you make a purchase, the app records it, keeping your budget updated. This feature ensures that you’re always aware of your financial status. These apps eliminate the need for time-consuming manual data entry, reducing errors and saving time. This immediate tracking fosters informed spending decisions, encouraging financial discipline.

Insights into spending habits

Money-tracking apps yield valuable insights into personal spending habits. They carefully analyze your transactions, breaking down expenses into food, transport, and entertainment categories. This allows for a clear understanding of where your funds are allocated. By visualizing expenditures, these apps facilitate targeted budget adjustments, promoting efficient money management.

Budgeting made simple

Budgeting is made simple with these apps. They automatically categorize expenses, providing an organized view of your spending. This helps align your financial habits with your budget goals. Furthermore, these apps offer interactive budget templates, making planning straightforward. Regular alerts notify users about their spending limit, fostering conscious money management. These features together simplify budgeting, making it a less daunting task.

Improved financial goals and savings

Money-tracking apps support goal-oriented saving, a crucial aspect of personal finance. By setting specific financial goals, these apps foster structured saving patterns. They also offer visual progress updates, promoting motivation and discipline. Regular reminders and goal-adjustment options provide flexibility, ensuring a balanced approach to saving.

The Psychological Impact on Spending Behavior

Money-tracking apps don’t just make financial management easier; they directly impact our spending behaviors. Let’s delve into how these digital tools subtly shape our financial habits. We’ll explore the psychology of spending and the role these apps play.

The shift from impulsive to informed purchasing

Money-tracking apps have catalyzed a significant transition from impulsive to informed purchasing. Users now have immediate access to their financial overview at the point of purchase. This visibility prompts a reassessment of buying decisions, curbing impulsive spending.

Consumers are now more likely to compare prices, prioritize needs over wants, and make purchases that align with their budget goals. This shift towards informed spending reflects an increased sense of financial responsibility and control.

The empowerment of financial control

Money-tracking apps facilitate a sense of empowerment in financial control. Users gain granular visibility over their finances, understanding every facet of their expenditure. This level of detail drives accountability, fostering a conscious spending strategy.

The apps’ predictive capabilities and personalized recommendations accommodate future planning, instilling financial confidence in users. This newfound control over personal finances can increase financial stability and long-term savings growth.

Tips for Optimizing Your Money-Tracking App Experience

Mastering your finances is no small feat. With a host of money-tracking apps at your disposal, optimizing your experience is essential. This section will provide tips to harness their full potential, guiding you towards financial control and growth.

Tailoring the app to your financial goals

The first step towards optimizing your money-tracking app experience is tailoring it to your financial goals. Assess your financial objectives, ranging from debt reduction to saving for a specific purpose. Once you have a clear direction, customize your app settings to align with these goals. This involves setting budget categories, spending limits, and savings targets that reflect your fiscal ambitions.

Regularly reviewing and adjusting these parameters ensures your money-tracking app remains relevant and effective. Remember, an optimally configured app can be a powerful compass guiding you toward financial success. This personalized approach will make the journey to achieving your financial goals smoother and more manageable.

Regularly updating and reviewing inputs

Consistency in updating and reviewing your input data is critical for maintaining the accuracy of your money-tracking app. Everyday transactions, from grocery bills to monthly subscriptions, should be promptly recorded. Regular data entry ensures the app provides real-time financial status, aiding in timely decision-making.

Additionally, reviewing these inputs is equally essential. This process helps identify any discrepancies, irregular patterns, or overlooked expenses. It cultivates a habit of financial mindfulness, enhancing one’s understanding of personal spending patterns.

Integrating with other financial tools

Integrating your money-tracking app with other financial tools can enhance its functionality. For instance, syncing with banking apps allows for automatic updates of transactions, ensuring real-time accuracy. Coupling with investment platforms can provide a holistic view of your financial status, including stocks and retirement funds.

Additionally, integration with tax software can facilitate seamless tax filing by accurately capturing all deductible expenses. Lastly, linking with digital wallets or payment apps can streamline the tracking of online expenses. Through these integrations, the money-tracking app becomes a comprehensive financial management tool. This improves your financial visibility, empowering informed decision-making.

Charting New Horizons: The New Age of Financial Mastery

In this new era of financial mastery, technology is the compass. Money-tracking apps bring us data and numbers, actionable insights, and real-time snapshots of our financial health. They transform us from reactive spenders to proactive savers. This shift is monumental, marking a significant evolution in our approach to money management. We’re no longer in the dark; technology has given us the tools to control and steer our financial future.

In conclusion, these apps’ influence over our financial behavior underscores their value. They have become indispensable in our financial toolkit by forging a path toward informed spending and empowered control. As we adapt and evolve in our financial journeys, money-tracking apps will remain our steadfast allies, guiding us into financial stability and growth. Embrace this new age of financial mastery and maximize the power at your fingertips.