Mearth E-Scooters Net Worth 2024 Update (Before & After Shark Tank)

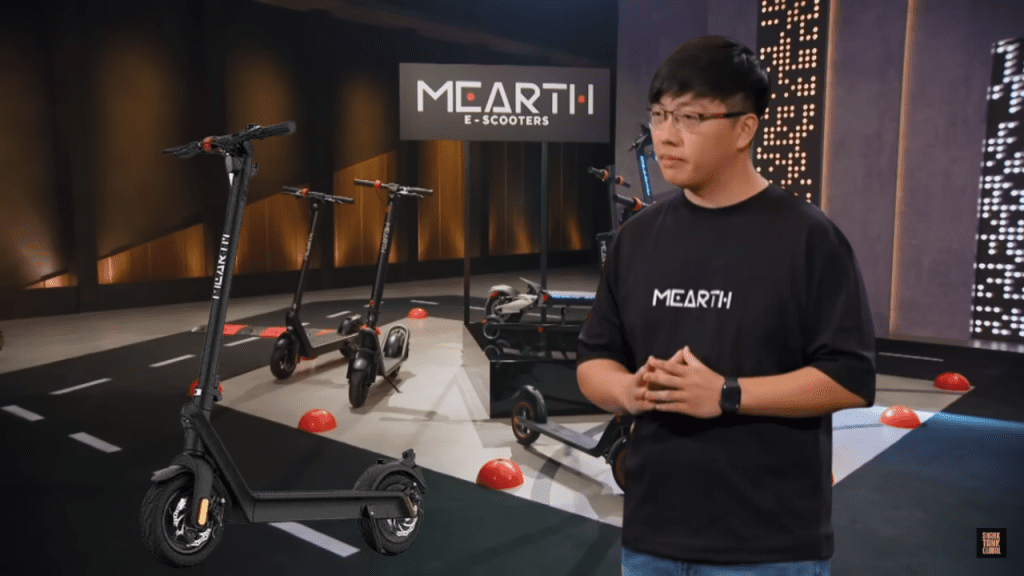

Mearth E-Scooters’ net worth was $12.5 million at the time of their pitch in 2023 based on the $250,000 offer for 1.8% of the equity of the company. Mearth E-Scooters is an electric scooter brand. Ming Ye created this in 2017.

They appeared on Season 5 of Shark Tank Australia in 2023. But the Sharks were not interested in investing in Mearth E-Scooters.

Sharks were impressed with Ming’s products. However, due to certain concerns including business valuation, Ming could not get a deal. Nevertheless, the show gave more visibility to this product, and as of 2024, it is active in business. Their products are currently available for Australia as well as New Zealand. To learn more about their scooters, and make purchases, head to the company website.

Mearth E-Scooters Net Worth

| Net worth | $12.5 million (2023) |

| Annual Sales Revenue | $3.5 million (2022) |

| Profits | $100,000 |

| Lifetime sales | Not available |

| Investor | None |

| Investment | None |

| Founder | Ming Ye |

| Employees | 11-50 |

Mearth E-Scooters Net Worth Timeline

| Net Worth 2024 | Not available |

| Net worth valuation 2023 before appearing on Shark Tank | $12.5 million (Business valuation) |

Mearth E-Scooters Pitch on Shark Tank

| Product | An electric scooter |

| Episode | Season 05 Episode 05 |

| Founder | Ming Ye |

| Asked for | $250,000 for 1.8% equity |

| Company name | Mearth E-Scooters |

| Final deal | No deal |

| Shark | No shark |

| Location | Sydney, New South Wales |

Don’t miss these products from Season 5

Mearth E-Scooters Founder

Ming Ye founded Mearth E-Scooters in 2017. Ming studied Mechatronics Engineering at the University of Sydney. He is a passionate engineer also a promising young entrepreneur. Mearth E-Scooters’ founder Ming Ye’s net worth is unknown as of 2024.

Key accomplishments

| Year | Accomplishment |

| 2023 | The company was featured on Shark Tank and secured a deal. |

| 2024 | Mearth has built partnerships with several other companies including The Bike Kiosk. |

Conclusion

From their beginnings on Shark Tank to their current status as a thriving business, they have proven that with the right idea and execution, anything is possible. We can’t wait to see the future for Mearth E-Scooters and its continued success.

Responses