Car insurance can protect you from a lot of unexpected costs in the future, and if you are using a good plan, it will not cost you too much to keep the insurance protection active at all times. With the number of insurers available for US residents today, selecting one plan to go with can be really challenging for a lot of people.

You have to determine the insurance quotes you will get from multiple insurers based on your personal data. Once you have calculated the quotes, you would then compare them with each other to find the one that matches what you are interested in.

What are Car Insurance Quotes?

A car insurance quote is an estimate of what it would cost to get a car insurance plan from an insurer. It is determined using the information about yourself and your car that you provided in the process for determining the car insurance quote.

Information like your age, gender, marital status, driving records, and other details about your car, like its mileage, make, and model, affect the rates that the insurer would offer you for a car insurance agreement.

It’s important to note that a car insurance quote is just an estimate. The actual amount that the insurer would give as rates for insurance protection might be slightly different from what was given in the quotes. What matters is that the estimated quotes and the official rates would be similar once the information that is assessed at both stages is the same.

Why is it Important to Compare Insurance Quotes?

When getting car insurance, one thing that owners have to consider is the cost of the agreement. Insurance protection is really useful, but if it costs too much to get it, it would quickly become a burden, and regular payments would not be sustainable.

Comparing insurance quotes with mInsurance helps to resolve the problem of paying ridiculously high amounts for insurance policies. Insurance policies vary in terms of cost because things like the specific situation each person is in and the extent of coverage people search for from insurers differs.

Comparing insurance quotes will help you to find the insurance plan that gives you sufficient protection and does not require you to pay exorbitant fees to keep the protection on.

How do Insurers Determine Insurance Rates?

Insurers consider a few factors when deciding what exactly will make up the cost of the insurance policy for the user.

Personal Details

Personal details like your age, gender, marital status and similar factors are often considered. These play an important role because the insurer uses statistics to calculate the odds of you getting into an accident based on these details. For instance, younger people have accidents more than mature drivers, so your rates could be higher when you are a young person.

Similarly, your driving record is important here because it serves as proof of your behaviour on the road; hence it will affect the rates that the insurer provides.

Vehicle Information

The state of your car and the safety record of that car model will be considered by the insurer when calculating the rates. Also, other factors like how much you drive the car and the location where you drive will also be considered.

Credit-Based Insurance Score

Here, the insurance company uses the person’s credit history to calculate the tendency of the person to incur insurance losses. It could be used to determine whether a person is eligible for insurance protection or the rates that the person will be charged for it.

Type of Insurance Coverage

The amount of coverage that you are requesting from the insurer would also determine the rates that you would be charged. As a general rule, the more coverage you get, the higher the cost will be.

How to Compare Quotes from Multiple Insurers?

You can run through the entire process of comparing insurance quotes manually on your own. You generate the quotes and consider each of them against the other by yourself, but this will be a very lengthy and stressful process.

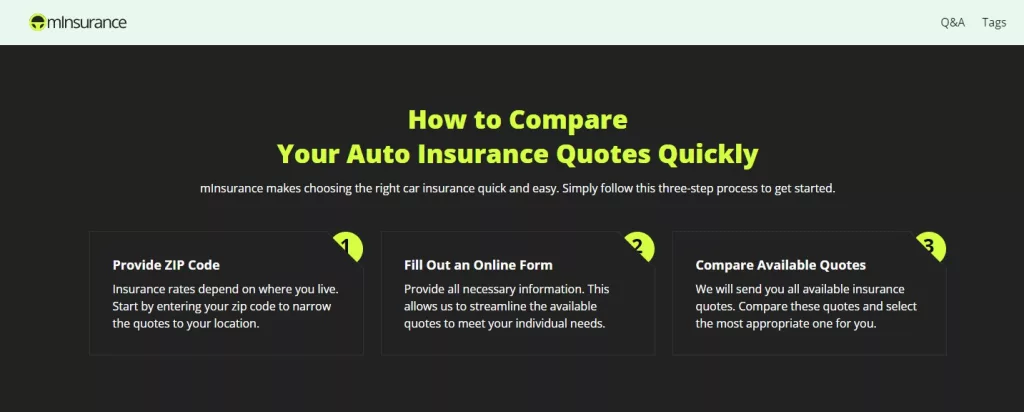

Instead of doing it manually, what many people do is compare car insurance quotes online using services like mInsurance. These platforms will only require you to fill in your ZIP code and some personal details. They will then use this information to generate all the insurance quotes that match your profile.

With all this information, you can now compare each one of the quotes against others side by side and select the right one when you make your decision. (If you want to expand your knowledge about cars in the US, such as Arkansas, visit mInsurance to find out more.)

Places to Getting Insurance Quotes

You can get insurance quotes from a variety of places. First, you can get it from the insurers themselves. If you have a specific insurer that you want to get insurance with, you can get a quote from them.

However, in most cases, people are not looking for a specific insurer but are looking for the one with the best deals for them. In this case, it is better to get insurance quotes from insurance quote comparison sites like mInsurance. Once you fill in all the required information, the site will generate insurance quotes that match your profile, and you can compare and select from their list.

How Does mInsurance Compare to Other Brands?

Presently, mInsurance stands out as one of the most preferred sites for insurance quote comparison because it is free, efficient and really easy to use. The entire process of discovering insurance quotes can be completed within minutes. The site also only requires the user to follow some basic steps to be done with the entire process on mInsurance.

When the results are generated, they are presented in a very basic format that anyone can read, understand and compare with other quotes. This solves the problem of insurance comparison sites being too complex for people to use.

Final Thoughts

You can save a lot of money by using the right insurance plan that matches your needs and income level. While this process can be really difficult when it is done manually, if you use an online comparison site like mInsurance, you can save a lot of time and effort and get better results from the service.