Image source: Unsplash

The potential of blockchain technology to revolutionize financial services is exciting, but how exactly can this revolutionary tool be used? Recent development in the space has seen different companies explore ways that blockchain technology can be utilized to improve the security and efficiency of payments, banking operations, regulatory compliance, and more. In this blog post, we’ll dive into some of the key ways that blockchain technology promises to disrupt today’s financial services industry – from increased transparency for investors through distributed ledgers to decreased transaction times with smart contracts. So whether you’re a financial services industry professional or just curious about how blockchain can impact the sector, read on to learn more about how innovative fintech firms are leveraging the power of decentralized systems to bring change across a range of financial processes.

Increase Data Security and Protect Consumer Information

Data breaches and cyber-attacks have become all too common. As a result, it’s more important than ever to increase data security and protect consumer information. With sensitive data such as social security numbers, credit card information, and personal addresses all stored online, consumers are inherently vulnerable to identity theft and other forms of cybercrime. Companies must take proactive measures to safeguard this information, such as implementing strong passwords, encryption protocols, and consistent monitoring of networks.

One way that blockchain technology can be used to increase data security is through distributed ledgers, which allow multiple parties to view and verify data without having access to the underlying source code. This eliminates the need for a centralized authority to control access and ensures that only verified participants are granted permission to view or edit information. Additionally, because all changes must be approved by consensus, malicious actors are unable to make unauthorized changes. This makes blockchain technology an ideal solution for storing and protecting sensitive data.

Enable Faster Payments with Smart Contracts

Another way that blockchain technology can revolutionize financial services is through smart contracts. Smart contracts allow two parties to enter into a binding agreement that’s verified and enforced by an automated system, eliminating the need for manual paperwork. This makes it much easier to process transactions quickly since parties are not reliant on each other or a third-party intermediary to ensure that payments are made on time. Additionally, since smart contracts can be programmed to carry out specific tasks automatically, they provide a way to automate routine processes such as interest calculations and payouts.

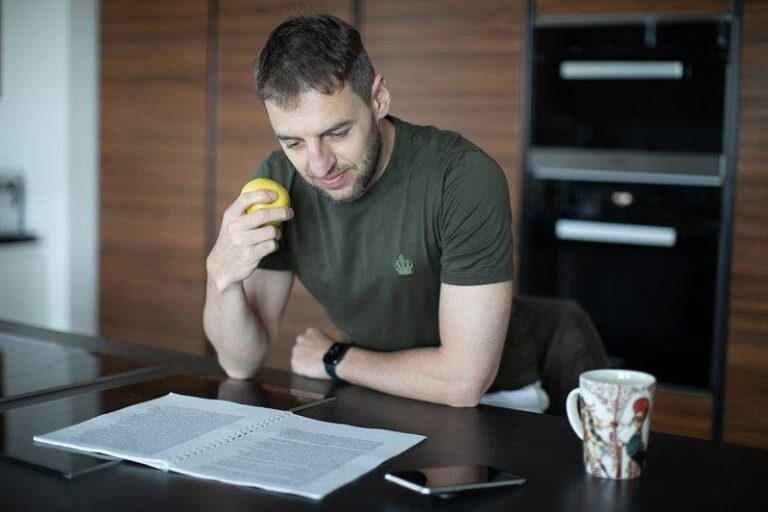

By leveraging the power of blockchain technology, companies can significantly streamline payments and transactions while ensuring accuracy and security. To ensure you’re up to date on the latest developments in this space, consider taking a FinTech and Blockchain technology online course or attending a relevant conference. This will help you stay ahead of the curve and ensure that your organization is prepared for the future of financial services.

Improve Regulatory Compliance

Blockchain technology also has the potential to make regulatory compliance simpler and less costly. By using distributed ledgers, companies can track all transactions in real time – making it easier for regulators to monitor financial activities and detect suspicious behavior. Moreover, smart contracts can be used to automate tedious compliance tasks such as ensuring KYC (Know Your Customer) and AML (anti-money laundering) checks are completed for each transaction. This not only helps reduce the time and cost associated with compliance but also makes it easier to adhere to changing regulations.

To ensure that blockchain solutions are compliant with existing regulations, it’s important to work with trusted partners who can provide expert advice and guidance. This will help ensure that proposed solutions are in line with current laws, helping businesses get up and running quickly and optimizing their operations for long-term success. Before making any decisions, it’s also important to consider the jurisdictional differences between countries – as some regions may have different laws and regulations that must be taken into account.

Increase Transparency with Distributed Ledgers

Finally, blockchain technology can be used to increase transparency and reduce the potential for fraud. By using distributed ledgers, businesses can track all transactions in real time – allowing them to quickly identify any discrepancies or suspicious activities. Moreover, because data is stored securely on a decentralized network, there’s no single point of failure that could be exploited by malicious actors. This makes it easier for companies to detect and prevent fraudulent activities before they occur, helping to protect their customers and build trust with consumers.

Keep in mind that before implementing any blockchain solutions, it’s important to ensure that all data is stored securely and that access is restricted to authorized personnel. Additionally, businesses should also consider partnering with reliable service providers who can provide expert guidance and support throughout the process. By taking the necessary precautions, companies can leverage the power of blockchain technology to revolutionize their operations while ensuring compliance and protecting against fraud.

Enhance Financial Inclusion

Financial inclusion refers to the accessibility and availability of financial services and products to all members of society, especially the underprivileged and marginalized. In the global digital age, enhancing financial inclusion has become increasingly paramount. Digital financial services and initiatives such as online loans, mobile banking, and e-wallets have made it easier for individuals to access and manage their finances, irrespective of geographical location and economic status. By enhancing financial inclusion, we can promote financial stability, economic growth, and poverty reduction.

Blockchain technology can play a major role in this endeavor. By leveraging the power of distributed ledgers and smart contracts, blockchain-based solutions can be used to provide financial services to more people, regardless of their location or economic status. This could include providing access to online payments and micro-loans for small businesses or providing easier remittance options for migrant workers. Moreover, blockchain technology also enables financial institutions and other service providers to reduce operational costs by automating tedious compliance tasks – allowing them to focus on improving customer experience instead.

Image source: Unsplash

It is clear to see that blockchain technology carries with it countless opportunities within the financial services sector. It has the potential to revolutionize the industry through powerful mechanisms such as data security, speedier payments, and transactions, fraud prevention, automated compliance and regulations, improved financial inclusion, and smart contracts. The many advantages of blockchain also come with its own set of challenges which will need to be addressed for companies deploying blockchain to guarantee customer confidence. As we move forward, the application of Blockchain technology in finance can only grow in importance amongst stakeholders and bring about an array of benefits for both businesses and consumers alike.