Crypto market making has gotten a lot of attention with stories about its ups and downs, extreme volatility, and high value or returns. As a newcomer to cryptocurrency investing, you’ve probably wondered, “What cryptocurrency should I invest in?” What are my options for getting started with my investment? What factors should be considered before investing? What is the expected profitability? Is it a good idea to invest in cryptocurrencies? Luckily, there are trading platforms out there like Swyftx Cryptocurrency Exchange that will make trading easy for you.

According to a recent analysis, there are more than 7,800 different digital currencies. This implies you might have a wide range of investing possibilities and ways to generate money. But which cryptocurrency is a good investment? Because the market is so unpredictable and no two crypto assets are the same, determining which is the most practical is going to be difficult. Fortunately, in this article, we’ll show you the basics of digital currencies and all you need to know.

Knowing The Difference Between Token and Coins

Tokens and coins are the two main types of cryptocurrency assets. They are frequently used interchangeably, but they truly signify two separate things. Coins are designed to be used as a kind of currency and are generated using their blockchain. Tokens, on the other hand, are built on top of the existing blockchain, allowing for the creation and implementation of specific smart contracts, which aids in identifying asset ownership that is not connected to the blockchain network. In addition, several digital currencies are classed as altcoins, which are blockchain-based but not bitcoin.

Where To Acquire Digital Currencies

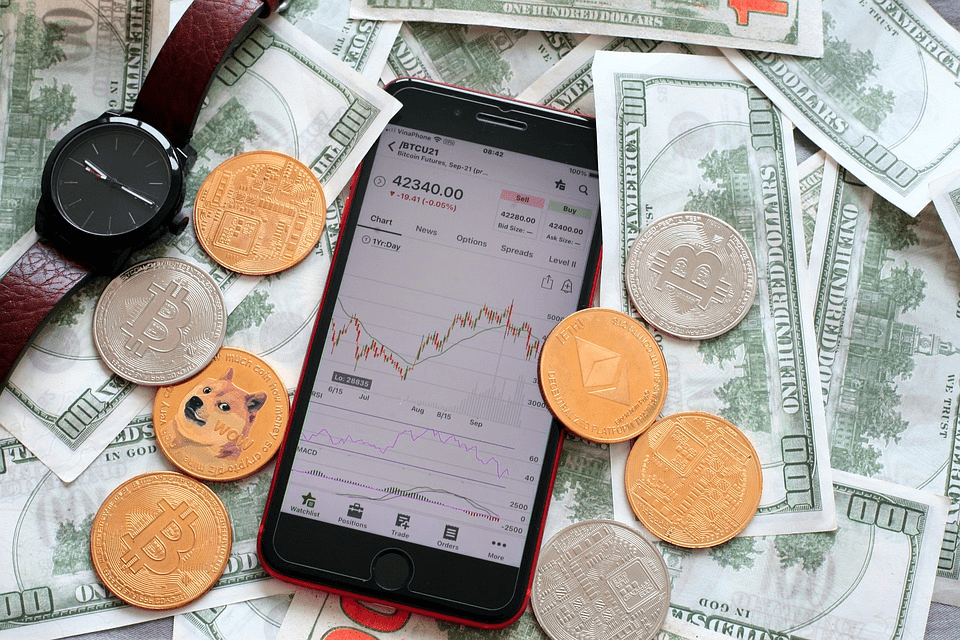

While certain cryptocurrencies, particularly Bitcoin, could be purchased using real currencies such as the US dollar, others are just purchasable with another crypto asset. However, to purchase cryptocurrencies, you must first obtain a digital wallet in which to keep the digital coins that you intend to buy. In general, you just open an account on a cryptocurrency exchange site and verify it. You may use it to send real money to buy cryptocurrencies such as Litecoin, Ethereum, Bitcoin, and many more.

Enhancing Your Research Skills

Cryptocurrencies are highly volatile currencies. When investing in crypto assets, there is a certain amount of risk involved. There have been instances where it will soar by 10% in a week and then depreciate by 15% in a day. You can forecast price changes of particular crypto assets by researching the crypto and staying up to date on its tendencies. If you want to find reputable cryptocurrency exchanges, and the sort of information that influences a crypto asset’s value, you must improve your research abilities. If you conduct proper research, you could avoid panic selling. The crypto media portal Cryptona.co is a good place to start, as it provides reliable content with their price predictions broker reviews, and it’s a great place for beginners in the cryptocurrency world.

Create Goals For Your Trading Portfolios

Income objectives and investment balances should be established first and foremost. Because you may refuse to deal if the extra money falls short of your goals, you should agree on a minimum amount that you are willing to tolerate. According to analysts, it is critical to set goals consistently so that others can observe how far you’ve progressed. Experienced investors appreciate the need of documenting every transaction, chart pattern markings, length, weekly beginning ranges, and objectives. Such statistics may assist anyone in identifying weaknesses in their present trading strategy and preventing them from happening in the long run. It is critical to remember that if you want to be productive, you must keep track of the progress at all times.

The Massive Impact Of Crypto Charts on Traders

It’s no surprise that many individuals are apprehensive about using crypto charts. They may look intimidating at first glance, especially if you don’t know how to decode them, but taking the time to comprehend them is undoubtedly beneficial. Even the most informed experts, however, cannot predict the future of the crypto business. Only market history and the ability to recognise patterns during price changes are the finest resources for investors and traders.

Regardless, these qualities require time to develop, but they should be a top priority for both new and established investors and traders. With that in mind, take the time to learn about crypto charts; you’ll be glad you did. If you’re serious about investing in digital currencies, having a better understanding of how crypto prices fluctuate is a significant reward for the time invested studying these sorts of charts. This not only makes you a better investor, but it also shows that you’re willing to put in the effort for your investment strategy.